Town Hall Meeting Speakers

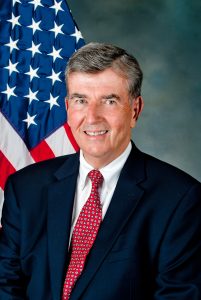

Senator Neil D. Breslin

Senator Neil D. Breslin

Neil David Breslin, Democrat, is currently serving as New York State Senator representing the 44th District, which consists of parts of Albany County and parts of Rensselaer County. Born as one of six children, Neil is a lifelong resident of Albany.

On academic scholarship, Neil attended Fordham College from which he graduated with a BS degree in Political Science. While in law school at the University of Toledo, he was named the editor-in-chief of the Law Review. Upon graduation from law school, Neil became an associate in the firm of Garry Cahill & Edmunds and two years later became a partner in a new firm entitled Garry, Cahill, Edmunds & Breslin. In 1981, Neil formed a partnership with his two brothers, Michael and Thomas. Currently, Neil practices law as “of counsel” to the firm of Barclay Damon, LLP.

Neil has been a community leader for many years. His involvement in civic and social areas in Albany includes 15 years as a board member of Arbor House, a residence facility for women in need. He also served as president of Arbor House for a period of seven years. Neil has been the attorney for St. Anne’s Institute in Albany and has performed work for Hospitality House, the International Center and Hope House, a drug treatment facility. Further, Neil was Vice President of the Interfaith Partnership for the Homeless from 1994 to 1998.

An active member of the New York State Bar Association, Neil has served as a lecturer on real estate law; editor of the newsletter of the New York State Bar Association General Practice of Law Section from 1980-1984; member of the Executive Committee of the General Practice of Law Section from 1980-1985 and from 1989-1998; chairperson of the General Practice of Law Section from 1993-1994; and member of the House of Delegates of the New York State Bar Association from 1992-1994. Additionally, he has been a member of the Character and Fitness Committee of the Appellate Division, Third Department and was also chairman of the Grievance Committee for the Albany County Bar Association from 1985-1993.

Neil currently serves as Co-Chair of the Legislative Ethics Commission and is a member of the Legislative Commission on Rural Resources. Neil is the former and longest serving President of the National Conference of Insurance Legislators (NCOIL) and is currently Chair of NCOIL’s Special Committee on Race in Insurance Underwriting. In addition, he is the former Chair of the State/Federal Relations Committee. In recognition of his dedication and commitment, Senator Breslin has received awards from numerous organizations including the Environmental Planning Lobby, Capital Area Council of Churches, the Legal Project, the Homeless Action Committee, Upper Hudson Planned Parenthood, Caregivers Respite Services of Catholic Charities, University at Albany’s Presidential Honors Society, New York State Bar Association, American Civil Liberties Union, KidsPeace National Centers, Nelson A. Rockefeller College of Public Affairs and Policy (“Distinguished Public Service Award”) and Robert F. Kennedy Democratic Club (“Profiles in Courage Award”). In addition, in 2009, he was the recipient of the Pathways of Hope Award given by the Clearview Center, the Advocacy Award given by the International Center of the Capital Region, the Community Service Award from Centro Civico Hispanoamericano; and was honored by the Capital District Area Labor Federation for years of service to the labor movement and working families. He was also the recipient of the 2012 “Voice of Progress Award” given by the RFK Democratic Club and in 2013, he received the “Person of the Year Award” given by the Troy Youth Association. In 2014, he received the Distinguished Leadership Award given by the Autism Society of the Greater Capital Region. In 2015, he was named a Champion in Compassion, an award given by the Homeless and Travelers Aid Society. In 2017, he received the Centennial Medallion from Catholic Charities of the Diocese of Albany as well as the CWA Solidarity Award. In 2018, he received the Humanitarian Award from Living Resources. Most recently, in 2019, he received the 2019 Public Service Award from the Insurance Federation of New York.

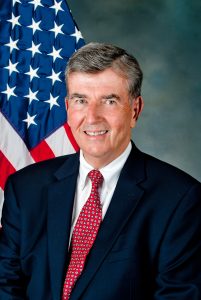

Assemblymember Kevin A. Cahill

Assemblymember Kevin A. Cahill

Representing the 103rd Assembly District which includes sections of Ulster and Dutchess Counties in the beautiful, historic Hudson Valley, Assemblymember Kevin Cahill was elected to the State Assembly in 1992.

Assemblymember Cahill was appointed to chair the Assembly Standing Committee on Insurance in 2013. He has been on the forefront in the effort to provide New Yorkers with quality, affordable insurance for home, health and property. In the aftermath of Hurricane Sandy, he shepherded bills through the Assembly to improve disaster preparedness and ensure that residents had appropriate access to their claims. He has also fought for health insurance coverage for substance abuse disorders, the essential benefits of the Affordable Care Act and comprehensive contraception availability.

As the former Chair of the Assembly Standing Committee on Energy, Assemblymember Cahill led the way with initiatives promoting renewable power generation, sustainable building practices, energy efficiency and the development of a green workforce. These successes preserved our environment and insulated us from the uncertainty of global energy markets, putting New York on the path to energy independence.

With his forward-looking approach, Kevin Cahill has steadfastly fought to protect our environment thereby preserving the beauty and natural resources of New York State for future generations. In recognition of his efforts, he was named Legislator of the Year by the Environmental Planning Lobby in 2008.

Assemblymember Cahill believes in the value of providing a strong education to the young people of our State. He has actively sought alternative ways of financing our public education system and reforming our property tax structure. Kevin Cahill authored the Equity in Education Act, which calls for full state funding of public schools. He encourages our children to develop a strong passion for literature through his annual summer reading program. The Assemblymember has championed funding for improvements for local libraries, the Mid-Hudson Library System, the Agribusiness Child Development in Kingston and the Rhinebeck School District Science Lab. He also developed an initiative to bring science and technology laboratories to each school district in the communities he serves.

The 103rd Assembly District is home to Ulster County Community College, SUNY New Paltz and Bard College. Many of the students in the district also attend nearby Dutchess County Community College. In his commitment to higher education, Kevin has been a staunch advocate securing vital funding for enhanced access, modernization and expansion on the various campuses.

Recognizing the importance of the arts to our region’s character and economy, Assemblymember Cahill has provided unwavering support for local arts organizations. Kevin has been effective in securing grants in the communities he represents, helping municipalities and not-for-profits obtain funding including the Woodstock Community Center, the Rosendale Theater, the Hudson River Maritime Museum Education Building, the Bardavon/Ulster Performing Arts Center, the Phoenicia Festival of the Voice and Ross Park in Esopus, to name but a few.

Kevin Cahill is a graduate of SUNY New Paltz and Albany Law School. He is an attorney and served as director of a Medicare health plan. He is the Chair of the Health, Long-Term Care & Health Retirement Issues Committee of the National Conference of Insurance Legislators and is an active member of the National Conference of State Legislatures.

A lifelong resident of Kingston, Kevin is the proud father of two daughters and enjoys time with his three grandchildren. He keeps the best interests of his constituents in mind to fervently advocate on behalf of the people of his district and all of New York.

Senator Neil D. Breslin

Senator Neil D. Breslin Assemblymember Kevin A. Cahill

Assemblymember Kevin A. Cahill Mark Murray, Managing Director, Strategic Advisory, Guy Carpenter & Company, LLC

Mark Murray, Managing Director, Strategic Advisory, Guy Carpenter & Company, LLC James Waller, PhD, Research Meteorologist, Global Strategic Advisory, Guy Carpenter & Company, LLC

James Waller, PhD, Research Meteorologist, Global Strategic Advisory, Guy Carpenter & Company, LLC